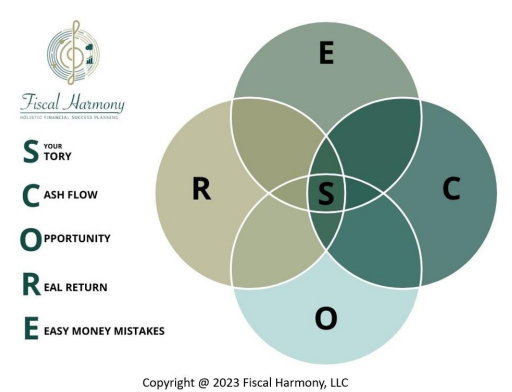

What is your SCORE?

Everyone has a history of experiences that guide our decision making, including me. Sometimes we are very aware of how our past influences our decisions in the present, and sometimes it colors our thinking in ways in which we aren’t aware, creating blind spots. I became a financial advisor after experiencing the negative ramifications of those blind spots in our family business. After more than a decade as a financial advisor and CFP®, I’ve realized that managing money is both science and art. Many entrepreneurial pursuits are the marriage of the two, but I find that money in particular has an emotional component that is linked to our past experiences. This led me to me establishing my own financial practice and methodology, Fiscal HarmonyTM. It all starts with the SCORE.

S – Your Story

Money is personal because it’s a tool to support your personal pursuits, your family, your aspirations, your goals. A great financial plan is unique to your life and circumstances. As an advisor, investing time to understand your personal story helps me build comprehensive and specific plans. You wouldn’t expect to rent Harry Potter and hear the opening music for Jaws. I can’t build your SCORE until I understand your story. It takes both science and human understanding to help my clients form long term successful financial plans and create Fiscal HarmonyTM. Your story is crucial to building your SCORE and may evolve in today’s rapidly changing environment.

What is yourstory? How did your family experiences affect how you feel about money?

C – Cash and Cash Flow

Cash and cash flow are linked and are mission critical step two. The latest Government of Accountability Office figures reflect that 45% of Americans don’t identify as employees. The gig economy is growing for all strata of the work force from side hustle to highly educated professional services professionals with a wealth of experience. Some of our clients find their work life in motion from employed to contract as our world of work continues to evolve post-Covid.

As disruption continues to define our economy, more “accidental” entrepreneurs will emerge. Evolving from employee to owner can be challenging. The focus of my financial practice is to establish sound plans based on the needs of the business owner and serve them on a deeper level.

I grew up in an entrepreneurial family and had both the privilege and pain to watch my family grow and lose successful businesses. Understanding your cash flow needs to develop the cash strategy is paramount. Cash is king when disruption happens because it allows you to make strategic, and often opportunistic decisions. Disruption is neither good nor bad, it’s the balance of preparation meets opportunity.

Has economic or business disruption affected your family? Did you have the financial ability to pursue an opportunity that presented itself?

O – Opportunity

Oprah Winfrey once said: “Luck is when preparation meets opportunity.”

Many of the families we serve are experts in their respective fields with both high compensation and high pressure. As families navigate caring for parents, and sometimes children at the same time, flexibility and options become of greater importance. Work life balance often feels elusive, work life blend is far more achievable. Following our SCORE methodology building cash flow models have allowed our clients to:

- Start a new consulting business out of state to be closer to a parent after being widowed.

- Achieve work life blend by taking a lower paying job finding fulfillment and more family time.

- Retain key personnel in an existing business after covid disruptions by taking a smaller paycheck.

- Expand an existing business into new ventures when opportunities unexpectedly popped up.

Working with clients effectively is both helping them plan and helping them evaluate when a course correction needs to be made based on their story. Cash on hand allows us to make better strategic decisions and yoke opportunities. After a decade of working with clients, I’ve found that the best decisions are made in a state of calm and not at either end of the emotional spectrum.

R – Real Return

The best plan balances an appropriate amount of cash and assets. Having assets that will keep growing will preserve your buying power long term.

My family was heartbroken when my 80-year-old grandmother, and primary caretaker of our

grandfather during his cancer, developed breast cancer herself. My grandmother was a woman of strength who lived through wars, the Great Depression, and numerous other challenges. She boldly decided she would not undergo chemo or radiation following the surgery even though the cancer had spread. She recently passed away at the age of 100! You never know what life will hand you, but you don’t want to outlive your money.

Preserving purchasing power is the counterbalance of cash. Equities can help ensure we don’t outlive our money. On January 2, 1990, the S&P 500 was valued at 353. On December 31, 2019, the value was 3,230 according to research provided by Advisors Capital Management. Maintaining purchasing power over longer timeframes is key to having options, and a key component of your unique and customized plan.

Not sure about your strategy? Is longevity part of your family picture?

E – Easy Money

There is an unlimited amount of easy money mistakes: too good to be true, fear of missing out,

something sexy and exciting…you name it, I’ve heard it in my decade in the financial industry. All too often, the stories that follow are heartbreaking. In the 90s it was the euphoria of the limitless horizon of tech; more recently, it was the collapse of the exchange traded note market.

“Bankrupt in just two weeks” appeared in the Wall Street Journal on June 1, 2020. The article followed hard working investors that added exchange-traded notes to their portfolios to “make up for lost time” in the financial crisis of 2008-2009 with disastrous results. The juicy yields lured investors as the market performed post crisis. The results of chasing high return strategies left many investors devastated as markets corrected.

Have you ever found yourself tempted by the idea of easy money? Have you been distracted from or lost sight of your goal?

“Money is only a tool. It will take you wherever you wish but it will not replace you as the driver.”

-Ayn Rand

Not having a plan can be like taking a road trip with no destination, GPS, or map. Having a plan and the right navigation tools means that you are far more likely to arrive at your intended destination.

Establishing a plan gives investors a “lens” to help evaluate options that may or may not meet their long-term goals and needs. Having financial resources means you have options and choices. For me personally, it’s both options for my family, as well as the opportunity to pursue passion projects like influencing and mentoring business owners around the world and in my city. Business can be a platform for change that touches lives through generations. I learned that from my grandfather, Bud Salm.

Are you ready to build your SCORE? What’s your first step? How will investing your time to build your SCORE change your life and your family’s life?

Need some help? More resources, articles, and tools can be found at www.fiscalharmony.com.