PROFESSIONAL PROFILE

Michael E. DeMassa, CFA, CFP®

www.forzawealth.com

Professional Approach

Our Independent Approach to Wealth Management

Get Advice, Not a Sales Pitch

Many wealth management companies act as though they are offering their clients customized portfolio options, but are actually funnelling clients into predetermined portfolios that are inflexible. This lack of transparency and agility can make it difficult to reach your personal financial goals.

At Forza Wealth Management, we understand how frustrating it can be not having direct access to the person making investment decisions that affect your financial future. We believe a personal relationship with your portfolio manager is essential to helping you reach your financial goals.

Long-Term Relationships Matter

Our diverse work experience over the past 20 years at major brokerage firms and trust companies inspired us to start FORZA in order to provide independent objective advice to our clients. We are committed to building long-term relationships and keeping our clients first. We look forward to the next 20 years of advising clients through life's journey.

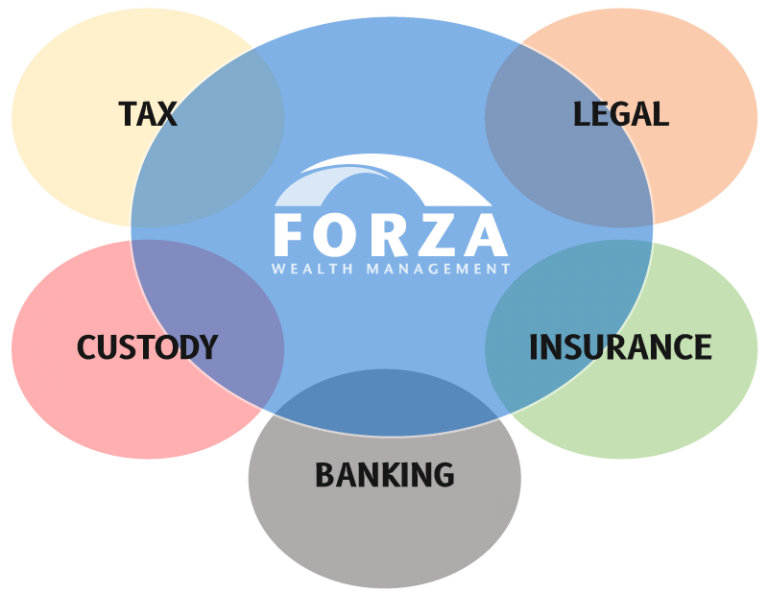

Collaboration with Your Outside Professionals

We put clients first in the investment adviser relationship without competing interests from related firms or shareholder profits. We work together with your Attorney, CPA and other professionals for an integrated wealth management approach.

Educational Background

Mr. DeMassa has over 20 years of experience advising clients to help them achieve their retirement and income goals. He is a graduate of M.I.T. and holds both the CERTIFIED FINANCIAL PLANNER™ certification and Chartered Financial Analyst® designation.

Learn more at www.forzawealth.com